Crypto Visions 2025

Positioning for the Altcoin Mania to Come

Welcome to the first Crypto Sitrep in Project Cryptograd, in which I will be offering my outlook on the crypto markets and position updates to paid subscribers.

I will not here or in subsequent Sitreps put in the disclaimer about this not being financial advice because it is cringe and I would assume goes without saying for my smart readers. Control risks, and don’t be a retard.

Market Outlook 🐂

Weakly bullish on $BTC and moderately bullish on alts (esp. Ethereum) as Trump honeymoon period unfolds over the next 3-6 months.

Good chance of altcoin mania/Steinhoff season soon to round off this bull run.

Bitcoin dominance.

BTC dominance has been going up relentlessly throughout this entire run with none of the alt seasons being fit for anything but ants. One thought I have had during the course of this run is that perhaps the patterns established in the previous two runs in which profits from BTC rotated into majors and then smallcaps might have been broken this time round, simply because so much of BTC’s market cap (mc) has been inflated by TradFi money going into the BTC ETFs. It’s not as if you can sell BTC ETF shares to buy altcoins. This, together with continuing high interest rates, will probably preclude the sort of stimmy-fueled madness we say in 2021. Still, ETH has ETFs too, and the much looser regulatory environment we can expect under Trump opens up the the prospect of speculative runs on other majors rumored to be getting an ETF. In this respect, DOGE in particular has bright prospects.

Ethereum: Eyes on the Prize

Holding Ethereum as a major component of one’s portfolio during this run has not been a fun experience to say the least, and I speak from personal experience. Bitcoin did much better as the first crypto asset to get an ETF. But Ethereum also underperformed many alts - most notably, Solana, which has has become the de facto shitcoin casino of this run, as BNB was to the last one. One possible explanation of this which I heard on a Bankless podcast was that Ethereum was already very “big” and had also declined much less than other alts during the 2022 bear season - Solana, recall, was the FTX coin, and got absolutely cratered from $260 to less than $10 - and so the whales couldn’t be bothered pumping ETH when they could pump Solana and AI vaporware instead.

However, I do not HODL Ethereum as a speculative investment, but simply because I view it as both the most prospective and the currently most undervalued major crypto asset. It is the most credibly decentralized chain - Solana is cheaper and faster, but this comes at the host of much stronger centralization (validators having to restart the network from Anatoly Yakovenko’s Discord servers has become a meme for a reason).

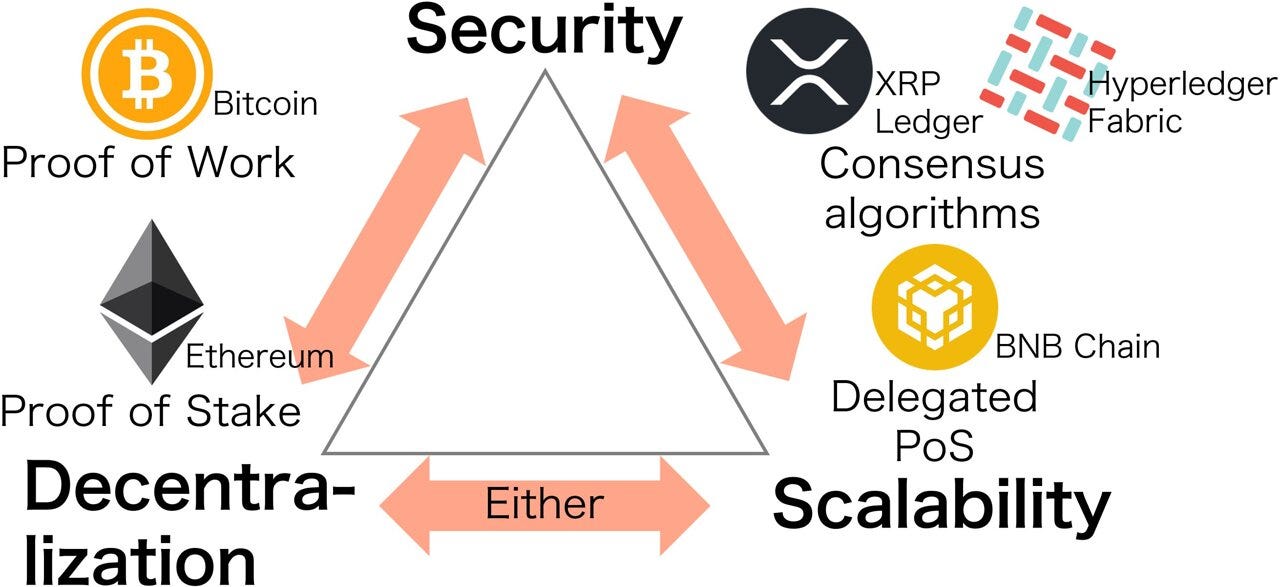

At a broader level, there is something called the “Blockchain Trilemma” which describes an intrinsic tradeoff between decentralization, security, and scalability. Ethereum prioritizes decentralization and security, hence the high transaction costs on its base layer, i.e. this is why you have to spend a few dollars on “gas” whenever you swap tokens on Uniswap. Ethereum’s scalability comes from so-called Layer 2s that inherit its security while bundling multiple transactions, and only relying on the base layer for settlement. A blockchain like Solana focuses more on scalability, but that comes at the price of lower decentralization. Different chains, different use cases. However, at the end of the day, it is decentralization that constitutes blockchain’s unique selling point - something that’s secure and indefinitely scalable is called a database. You know, that thing TradFi uses. What’s the actual need for a blockchain when you have MySQL?

This is why almost all serious applications in crypto load on Ethereum. DeFi blue chips are native to Ethereum. DeSci tokens and treasuries are on Ethereum. When Coinbase created Base, its own L2 rollup, it launched it on Ethereum - not on any other chain, nor on its own chain. Paypal launched its USD stablecoin on Ethereum. Sony very recently launched its L2 on, you, guessed it, Ethereum. Basically whenever serious TradFi companies such as Blackrock, Visa, Stripe, or Microsoft want to integrate their products with crypto, they do it on Ethereum. That is because Ethereum is the biggest and most decentralized chain alongside Bitcoin, but unlike Bitcoin, it also allows for smart contracts, the self-executing programs on the blockchain that auto-execute agreements when predefined conditions are met.

As I mentioned, my core thesis is that decentralized blockchains are the most rigorous frameworks for securing value in the digital realm. Consequently, as digitization proceeds apace - a process that AGI will vastly accelerate - the value of the network that best fulfills this role will likewise teleport upwards. Bitcoin doesn’t allow for smart contracts, so while very decentralized, you are very limited in what you can build on it. Solana is sleeker, sexier, and more scalable, but is much less decentralized. You can use it for flipping shitcoins, but BlackRock is not going to entrust tens of billions of dollars to Anatoly’s Discord server. To the extent that cryptocurrency has a future beyond “digital gold” (Bitcoin) and speculation (Solana) - to the extent it has potential to reformat the world economy and society along cardinally new lines - the single best candidate for that is the Ethereum network and it isn’t even close. This is why I am HODLing Ethereum to $1 million (sic).

ETH/BTC

As regards shorter/saner timescales, I think Ethereum has the best risk-to-reward ratio of any crypto asset now:

The very fact of its underperformance against Bitcoin and Solana to date (mean reversion principle).

There will soon be Staked ETH ETF (this is bullish for Lido $LDO in particular).

Trump’s “World Liberty Fi” scam is most bullish on ETH (that’s where they’re sending the proceeds from the $TRUMP scam).

Though I definitely wouldn’t short it, things like the US President launching a shitcoin would be the exact kind of thing that classically marks tops in retrospect. $TRUMP is a Solana meme. I give it a good chance this marks this run’s SOL/ETH top, and while I certainly wouldn’t short Solana, I even allow there’s a chance it will be an absolute top at $295. Depends how much fuel there still is in the $TOTAL tank.

I am also intrigued by the fact that Solana’s mc peaked at 35% of Ethereum’s on Jan 18, 2025 - the date when Trump launched his shitcoin. BNB’s mc peaked at 39% on April 12, 2021. What Solana and BNB have in common is that they were the shitcoin casino network of choice in the 2020-21 and the current bull run, respectively. Sure, the designated casino chain can make further dominance gains - but is this a thesis you’d want to bet big on? The 2021 meme seasons were far, far wilder than anything we’ve had to date this run.

I don’t assign much weight to TA. But FWIW, the ETH chart is primed.

Final reason: This week has seen something like a sentiment collapse within Ethereum centered around dissatisfaction over the Ethereum Foundation’s management and Vitalik’s alleged culpability in it. One of its long-time developers and advocates Eric Conner (eric.eth) loudly left the building. This might look bearish from the side, but in reality such scandals often mark dominance bottoms.

I am mostly invested into ETH and will only consider starting to take profit at $7,000 dependent on how “toppy” sentiment is.

Allocation details and altcoins analysis for paid subscribers below. 👇