The Party's Over

When Bitcoin Is at $124,000 You Are NOT Early

I was bullposting about crypto since Bitcoin was at $25,500-30,000. I think I have earned the right to flip bearish now that it’s 4x higher at $120,000. Ethereum is up 3x from $1550-1700 when I shilled it, reaching a peak of $4,800 (just 1% shy of its previous ATH). Solana is up 7x from $25 to $180.

Many influencers are targeting $130,000-140,000 for Bitcoin and additional multiples for their favorite altcoins. I think that macro and the charts are bearish. After holding my Ethereum and other alts for two years, I will now disclose that I have sold most of my crypto portfolio into stables in the past several days and expect a bear market starting quite soon in both TradFi and crypto1.

There are two major macro reasons for this as well as reasons more specific to crypto.

Trump’s Tariffs

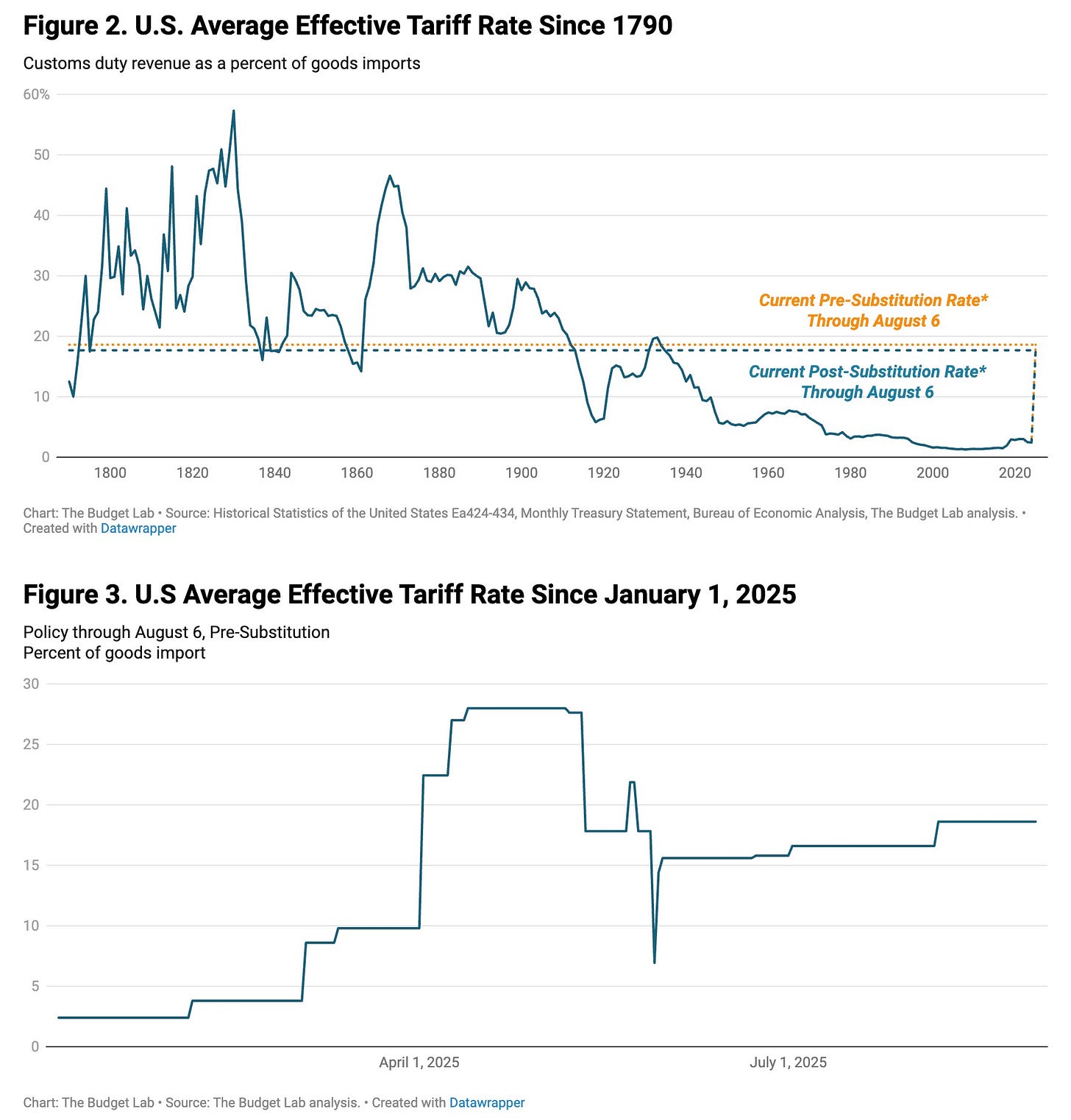

The markets panicked and the SPX lost 20% when Trump jacked up the effective tariff rate from near zero to 28%. Everyone breathed a sigh of relief and ran it back turbo when Trump relented. But the actual retreat was very short-lived. Having bottomed out at 15%, with a “complacent” consensus that they would continue going down, they're now back at 19%! Meanwhile, markets keep going up and up as if we now collectively believe that the highest effective tariff rates since 1933 are a nothingburger.

Perhaps Trump discovered some magical new economic paradigm in which none of this matters any longer, and perhaps this might have even been true had the trendline towards very short AGI timelines and US victory in this Civilization game been maintained. However, with imminent AGI seemingly no longer on the cards, I expect the laws of gravity are going to reassert themselves rather soon. From this perspective, the SPX - whose total market capitalization, now at 212% of GDP, has never been higher in history - increasingly resembles Wile E. Coyote running off a cliff and not yet realizing there’s nothing but empty space below.

AI Bubble

I am not necessarily saying that AGI is definitively no longer happening; this would be an unreasonable overcorrection to the 2022-early 2025 mania. However, AI risk researchers have been extending their timelines the past few months - the authors of AI 2027 now say they wish they’d called it “AI 2028”, or better yet, avoided dates entirely - and the unimpressive performance of GPT-5 has validated talk of a slowdown. We can’t yet say the scaling hypothesis has broken down. However, after teleporting from an IQ of 90 to 120 from early 2024 to early 2025, frontier LLM performance seems to have stalled at Redditor midwit level on TrackingAI’s offline test for the past half year and counting. Novel IQ tests are definitionally the best tools we have for measuring general intelligence, and are my own preferred metric for tracking progress towards AGI. Most high quality online text is 120 IQ midwit text, so intuitively, it would not be surprising if that is precisely where next token predictors converge to regardless of how much more compute is thrown at training them.

However, this is not a post about AGI. It’s a post about AI expectations that have driven the great bulk of recent SPX gains that market participants increasingly recognize were inflated, at least in the short to medium term. There are well known systemic problems, such as the fact that all of these AI companies are operating at a loss and burning massive amounts of cash to retain users. Beyond that, I see top signal after top signal. Ilya Sutskever refusing $32B from Meta for Safe Superintelligence (which might still be just vaporware for all we know). Mark Zuckerberg offering OpenAI and Thinking Machines researchers $1B bribes to join him - and getting turned down! These are the vibes of late stage crypto manias, such as richard.eth rejecting $10M for a CryptoPunk NFT in October 2021. Speaking of crypto, it is oddly appropriate that Zuckerberg is again the main trendsetter, pivoting Facebook into the metaverse and renaming it “Meta” in late October 2021. The metaverse/GameFi pico-top, which I called to the day, happened just a month later on November 24. Is Zuckerberg going to top-tick AI as well?

I should emphasize I don’t specifically seek out top signals. This is a very bad and counterproductive thing to do! However, I can’t help but notice that they’re multiplying even at the mundane level of San Francisco life. I see people walking away with lucrative VC deals for any dog of a project with the right AI buzzwords. I went to a “vibe coding” event - hosted by Worldcoin! - fronted by a guy who wins hackathons without being able to actually code. Such strange phenomena only tend to happen and be widely accepted during manic phases. Just yesterday I saw that Anthropic was refocusing on the “model welfare” of Claude. If AGI was really within their sights I do not think they would be wasting their time on the subjective states of next token predictors.

I think we are at or very close to the pico-top of the AI narrative. “Tech” is now close to a synonym for AI, while its weight in the broader SPX has never been higher (just Nvidia by itself contributes 8%, the largest percentage accruing to a single company since records began in 1981). The popping of the AI bubble will drive down markets across the board, and the main question is when it happens. When conversations drift to this topic in San Francisco, there is now relatively widespread acceptance that we are in a bubble, but few are positioned short. The default expectation is that the party will continue for a couple more years, or at least until the end of Q4. Obviously, timing market tops is a fool’s errand, and I have no plans to buy puts. However, the combination of flashing top signals, Trump’s tariffs, and the OOM-tier gains for companies like Nvidia and Meta since late 2022 means that the r:r for staying heavily invested in these markets has become very dubious.

Crypto Copelets

What effect will AI bubble popping - if and when it happens - have on crypto? One of the lessons any crypto newbie learns during their first cycle is that crypto is downstream of TradFi markets. Stock market movements get magnified in crypto - that is, we say that crypto is “beta” to stocks. When TradFi retreats, crypto gets crushed, regardless of its own dynamcis at the time. Conversely, when TradFi goes up, the resulting wave of liquidity lifts all boats, teleporting crypto assets upwards. Towards the tail end of such bull markets, all kinds of craziness ascends to gloriously idiotic levels (the “scams pump hardest” principle). High quality assets do win out (gain “dominance”) over inherently valueless shitcoins over the long-term - long-term, almost everything has gone to zero against Bitcoin and Ethereum - but this is a slow and grinding process that happens over the course of years.

The one “bullish” aspect of an AI crash I can potentially see for crypto is that all the hot money chasing AI vaporware will instead be funneled to crypto vaporware as in 2020-21. However, these two worlds don’t intersect much at the financial layer, and besides, the direct QQQ and SPX collapse will completely dominate any hypothetical second-order effects. (SPX and Bitcoin movements normally correlate ~0.4, and explode to 0.7-0.9 during periods of high volatility). No matter how great you think your “project” is, no matter how resilient you think it is to macro shocks, you are almost certainly wrong about it and if you hold on to it during the bear, expect to become a “community member” and see your holdings go down by 90% or evaporate entirely if the team exits in search of “new opportunities”.

So for me, the main question comes down to, when we can expect to see the end of the crypto bull market? Personally, I believe there will either soon come a bear market, or in the best case scenario, a deep correction, in the event that AI and the US economy remain resilient against all the odds. Here are the warning signs I am seeing.

First, there is the banal fact that valuations are already extremely high. This does not just apply to quality (credibly decentralized) crypto assets such as Bitcoin and Ethereum - in an ever more digital world, we may reasonably expect their market caps to continue increasing as a share of total world capitalization, since they are the most rigorous framework for property rights in the digital realm - but to “fossil” assets, pseudo-scams, and memecoins that have ~zero inherent value.

#3 is Ripple $XRP, a centralized grift beloved of by taxi drivers and finance bros, but used by nobody, is up 10x up from the bear market lows with a market cap of $177B. Hedera $HBAR at #17 fits a similar category.

#10 is Tron $TRX, a chain with a shady ownership structure that is near exclusively used to send USDT payments and is run by a colorful individual who gets SEC investigations like actresses get paparazzi shots, is in up-only mode.

#12 we have Hyperliquid $HYPE, the latest iteration of the classic crypto trope of a grossly overvalued de facto centralized exchange in decentralized clothing (predecessors: DYDX; Mango Markets). Meanwhile, GMX - arguably the most legitimate protocol in this category - languishes at just 1% of Hyperliquid’s market cap.

Ethena at #15 may unironically be this cycle’s equivalent of Luna, a synthetic stablecoin that depegged to zero on account of reflexive collapse.

Trump’s “World Liberty Financial” scam is at #45 while AI memecoin #FARTCOIN caps off this clown market at #83.

In a healthy market, I want to see valuations dominated by Ethereum and its most developed L2s, other high quality L1s such as NEAR and Solana2, bluechip DeFi protocols like Aave and Uniswap, and genuinely innovative Web3 and Proof of Humanity protocols like Worldcoin or Kleros.

Second, the “institutions are buying.” This might sound bullish but only if this is your first rodeo. Smart money such as Blackrock and the Ethereum Foundation buy at the lows while fudding the retail goyim out of their underwater bags, and then sell it back to them at the highs while screeching, “Institutions are buying!” Bitcoin at $120,000 and Ethereum at $4,500 aren’t the lows. This time round, said institutions are ETH treasuries, which are said to be accumulating Ethereum hand over fist and driving the price back up to all time highs in the process. The problem is that any price movement has a post facto narrative explanation. However, in almost all cases, the basic underlying mechanism is just money “rotating” between varying clusters of crypto assets such as Bitcoin, the “Ethereum ecosystem”, the “Solana ecosystem”, “AI”, “NFTs”, etc., before players take their profit into stablecoins during corrections and bear markets. These rotations tend to be random and very hard to predict, although there are some rules of thumb, e.g. Bitcoin tends to recover first from the bear market, while Ethereum teleporting upwards tends to mark end stage mania. (Uh-oh).

Third, people are asking, agonizing: “Where is the alts season that was promised?!” But we just had an alts season! To be sure, it was a very disappointing alts season, dominated by fossil coins as it was, with fewer memes and “innovations” like the OHM ponzis. But with $TOTAL2 (market cap of all non-BTC cryptos) matching previous November 2021 ATH, what else do you reasonably want? Money is tighter this time round. Interest rates aren’t at zero, and Trump is taking money from your pockets with his tariffs, not giving it out as COVID stimmies.

You want to inquire about the meme season. We have had a 2020-21 bull run-scale “meme season” since February 2024!! I am sorry that your particular shitcoin didn’t pump 100x. Neither did mine. I hope you practiced Risk Management 101 and kept it a small part of your portfolio. We have already had two distinct meme manias this run. The first one in the summer of 2024, which ended with the tokenized hamster races and Solana dogwifhat coin getting displayed on the Vegas dome. The January 2025 one with President Donald Trump shilling his own $TRUMP shitcoin to the MAGA faithful. Perhaps we get a third one to power the final blow-off top. Or we might not! Nobody owes it to you to give your shitcoin an exit pump. Inflation is eating at discretionary spending, people are tired of memecoins, and many have already been burned by them - either in the last bull run, or in the two meme manias of this run - and are in no rush for seconds.

Learn to appreciate the degeneracy we already have because I am not sure it will be here for much longer. Dogecoin is at $0.22 (market cap: $33B) or up 4x from the bear market lows. Perhaps you expected higher. But this is a useless, constantly inflating asset that pumped big in 2020-21 because Elon was still cool back then and actively shilling it. Today he is viewed as a sieg heiling weirdo by many. At #30 you have $PEPE, once calumniated as an Alt Right meme, at $5B. That already is a highly improbable outcome. I have mentioned $FARTCOIN and dogwifhat; both are in the Top 100, as is the last run’s second-tier dog $FLOKI. Dear mother of Christ, there is currently a coin at #163 literally called $USELESS at $300M market cap. Degens are self-consciously playing shitcoin musical chairs in a last desperate big to make it before the music stops and you are asking me where is the meme season. You are the meme, that’s who. We deserve zero just for asking about meme season!

Not Early

I am not your financial advisor, and all my commentary on these matters is for entertainment purposes only. I don’t presume to know the future. For all the above, while I am reasonably sure $124,000 was the Bitcoin top, I still think there’s a ~50/50 chance that Ethereum can surge back up, break above $5,000, and go into price discovery mode all the way to $7,000 or whatever. I still HODL some Ethereum myself.

However, I also think the r:r on this is very low. The meat of the move, such as it was, was from $1,500 to $4,500. I am not going to risk buying a return ticket in the hope of another 50% - assuming I even catch that top. I have always been open that my ultra-bullish thesis on Ethereum - seeing it going to $20,000-30,000 or higher - this cycle was in part predicated on fast AGI timelines.

However, since these timelines are now slipping away, I return to the real world in which the crypto industry for all its promise in revolutionizing finance and governance is wracked by problems such as dependence on macro (TradFi sneezes; crypto catches the flu), slow adoption, institutional hostility, and the admittedly high prevalence of scams and grifts that invite not entirely undeserved public suspicion and misunderstanding.

All I will say is that, at this point, you are not early. The tariffs are a ticking time bomb we decided to collectively ignore. AI is flashing top signals every other week. Geopolitical prospects are gloomy. Possibly futures encompass scenarios that include an intensification of the Russian-Ukrainian War (likely IMO), a Chinese invasion of Taiwan (if it happens, late 2020s are widely considered to be the peak danger years), and Trump deciding to become a dictator or join in on the annexation fun (wildly unlikely - but Trump is Trump, LOL). If you made life-changing money this run, consider locking some of it in.

I am not particularly thrilled about my performance this run relative to 2020-21. I was deepest into Ethereum, one of the worst performing majors, and of my memecoins/NFTs, only one out of my three holdings did a 10x (that was Milady - $ADOGE and $USA crabbed). Memes/NFTs are a casino, so analysis there is meaningless. However, I did over-privilege Ethereum based on fundamentals and its relative bear market strength. In the event, the actual bull market money went into Bitcoin ETFs from boomers who have never heard of “smart contracts” while degens pumped much lower market cap Solana as this run’s casino chain.

I recognize and acknowledge Solana’s real moves towards genuine decentralization since the last bull market.

Further top signals in just 2 days since this post:

* Meta freezes new AI hires just one month after $1B onboarding offers to elite researchers. (There was one month between Facebook becoming Meta and the metaverse/GameFi pico-top in Oct/Nov 2021).

* Chamath SPAC quotes Trump "no crying in the casino."

* Kanye launches $TRUMP-like shitcoin (6 wallets control 90%).

* Grok pivoting to "companion outfits".

https://x.com/powerfultakes/status/1958483025358197217

Thanks for your thoughts here, it is useful. I basically agree on crypto, but I'm less clear on the AI trade timing. Some counters:

- Meta freezing hiring is essentially a restructuring, and makes sense given extreme underperformance on Llama by already existing staff (hire a new team, get rid of the old team, go from there)

- Fed cutting cycle likely(?) coming soon

- NVDA earnings next week will likely be strong

- Hyperscalers are deeply incentived to continue capex spend at least through the end of the year, and that much spend should buoy eg NVDA profits

-OAI currently in talks for a 500b round and Anthropic at 170b, revenues for core companies are still growing massively, GPT 5 was a disappointment from a pure capabilities standpoint but may be very profitable w eg low inference cost. It doesn't feel like Wile E Coyote moment to me yet

To be clear, I am pretty uncertain on net, and eg hawkish Jackson Hole/Sept Fed meeting could easily catalyze a pop. It does feel close to a cycle top, barring major advancements from the leading labs.